Problem gambling, like other addictions, is largely misunderstood and overlooked in workplaces the world over.

Contrary to Vegas stereotypes, most employees with gambling addictions are not middle-aged men sporting pinkie rings and gold chains who squander their fortunes at high-stake blackjack tables.

Instead, gamblers are men and women of all ages and of every profession. Most problem gamblers are young – 25-34 – and hold respectable jobs or are high performing sportsmen who earn big money early in their working lives.

Problem gambler numbers are growing, thanks in part to the proliferation of casinos, community pubs with pokies, lotto, the internet and popularity of TV coverage of Texas Hold’em Poker among teens. Teens who get hooked on gambling have a greater chance of carrying it into adulthood.

Gambling addiction rivals all other addictions in its level of self-deception and mood swings. It’s cloaked in shame, denial, pre-meditation and suicidal tendencies. It is a disease of altered perceptions and tumultuous emotions.

Gambling itself is just a symptom; the core problem more often stems from low self-esteem and a lack of self-worth. Problem gamblers exude overconfidence, energy and are prone to boredom. They’re big spenders. The underbelly of the addiction shows markings of extreme stress, anxiety and depression.

People who gamble compulsively use the entire ritual to subconsciously self-medicate. The thing that separates them from non-problem gamblers is their defined loss of control around gambling: they are incapable of learning from past experience to moderate present behaviour. The prospect of dire consequences does not dissuade them from throwing the dice, putting coins in the slots or betting the house. Calculated risk is a foreign concept.

What is Compulsive or Problem Gambling?

The Diagnostic and Statistical Manual of Mental Disorders (Version IV) defines it as ‘the chronic and progressive failure to resist the impulse to gamble and act out gambling behaviour that compromises, disrupts or damages personal, family or vocational pursuits.

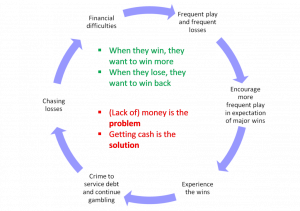

People who suffer from gambling disorders believe that money causes all their problems, and that cash can solve them. As their gambling escalates, they often resort to lying to get the financial resources needed to support the habit. They make no serious attempt to budget or save money.

When lying fails to produce results, they turn to antisocial behaviour – stealing, prostitution, or extortion to get funds. Their friends, family and co-workers are frequently lured into the gambler’s world – their employers become unwitting ‘financiers’.

Getting help

The progressive nature of gambling addiction eventually inspires someone in a person’s life to intercede on his or her behalf. It may be a partner, colleague, friend or a professional. This is a risky and courageous move. It involves breaking the conspiracy of silence that insulates the gambler from the realities of his or her disease. I

f no one steps forward, the addiction continues its downward spiral, until bill collectors, bankruptcy court or the law picks up the remnants of what had been a productive life.

The intervention should be a carefrontation, not a confrontation. Interview others affected, find out the extent of the debt, broken promises, broken relationships, deceit, lying, etc.

When you are confident that action is necessary:

- Ring Instep (0800 284 678) to ensure that you have followed a good process

- Arrange for a meeting with the gambler and for those affected to be present

- If you wish, ask for Instep to direct proceedings

- Instep will set up for assessment and treatment with a problem gambling clinical professional.

The Problem Gambling Foundation of New Zealand has plenty of information and resources.

You can download various fact sheets from their website, Problem Gambling Foundation • Take the first step in your journey to recovery (pgf.nz)